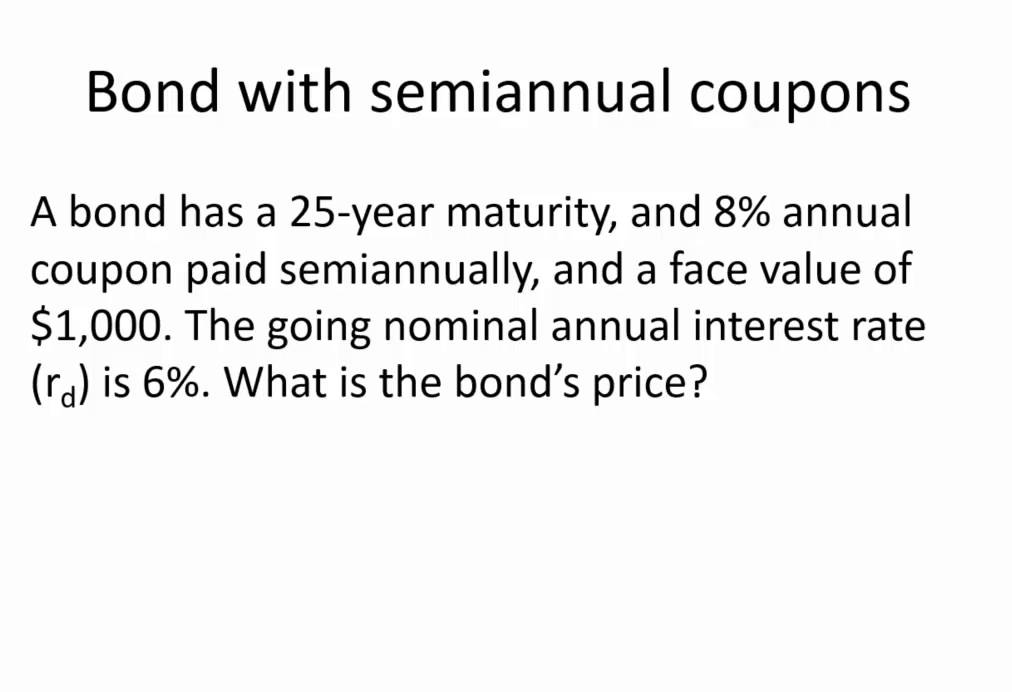

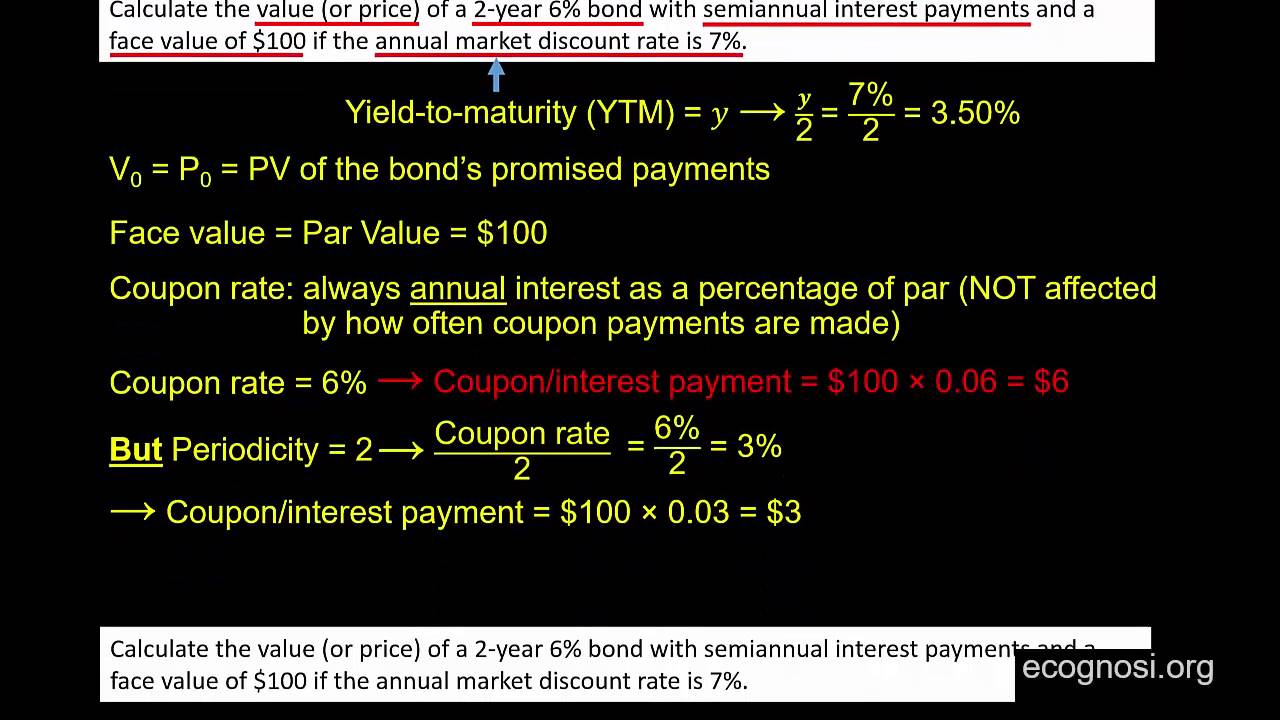

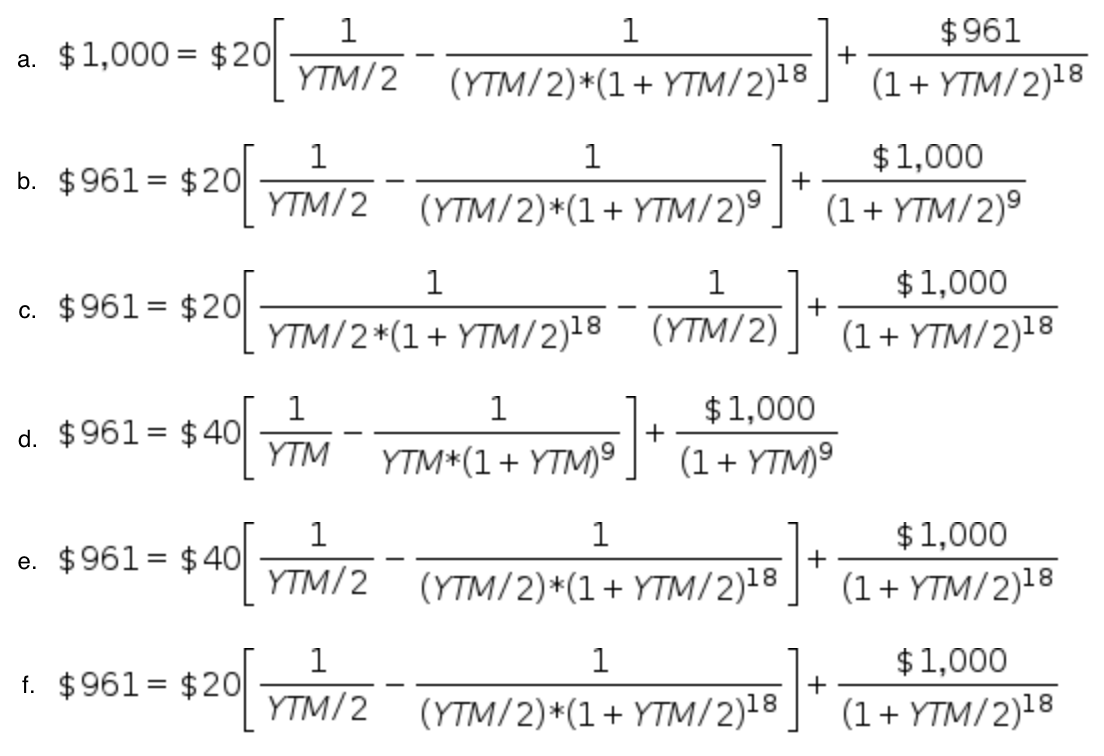

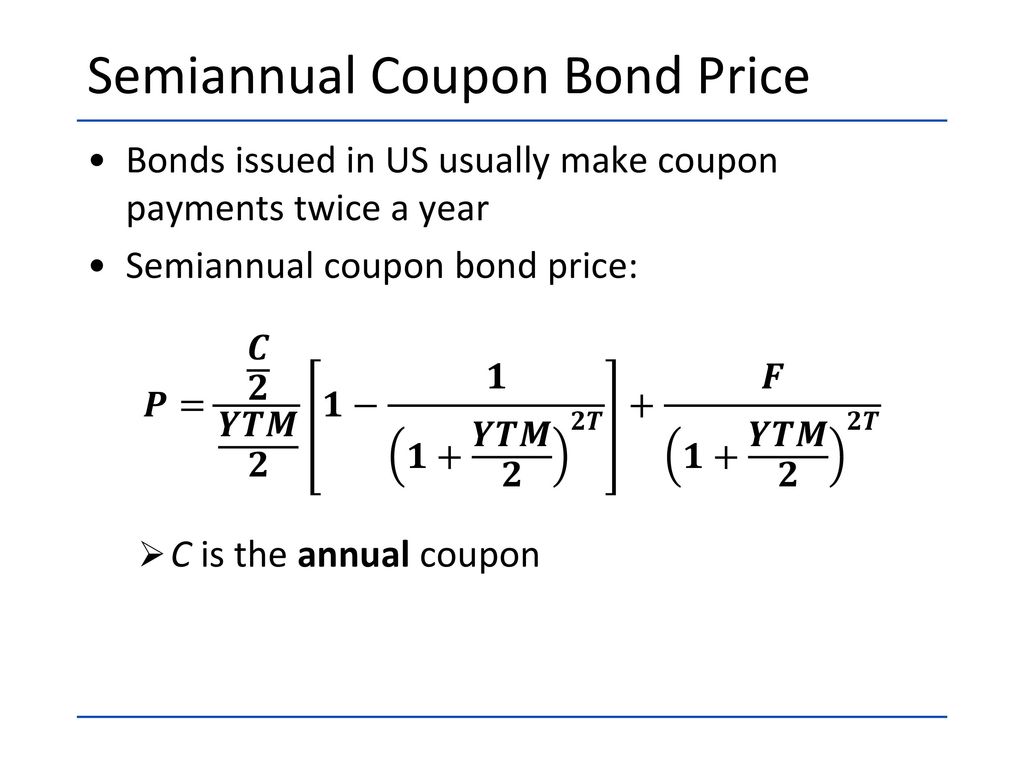

How to calculate the semi annual coupon of a bond with a maturity of five years that's priced to yield 8%, has a par value of $1,000, and has a face value

Bond Valuation Applying time value of money and annuity concept in order to value bond and determine bond yield. Importantly, we will examine the bond. - ppt video online download

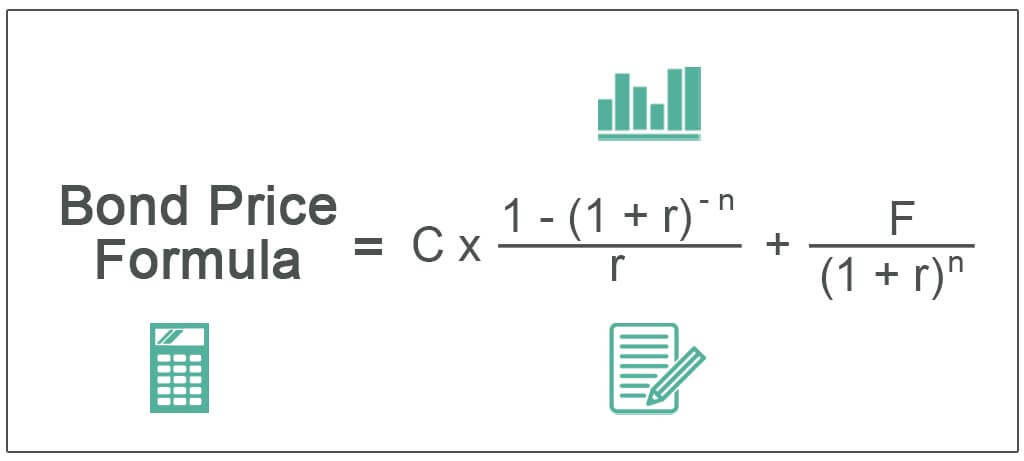

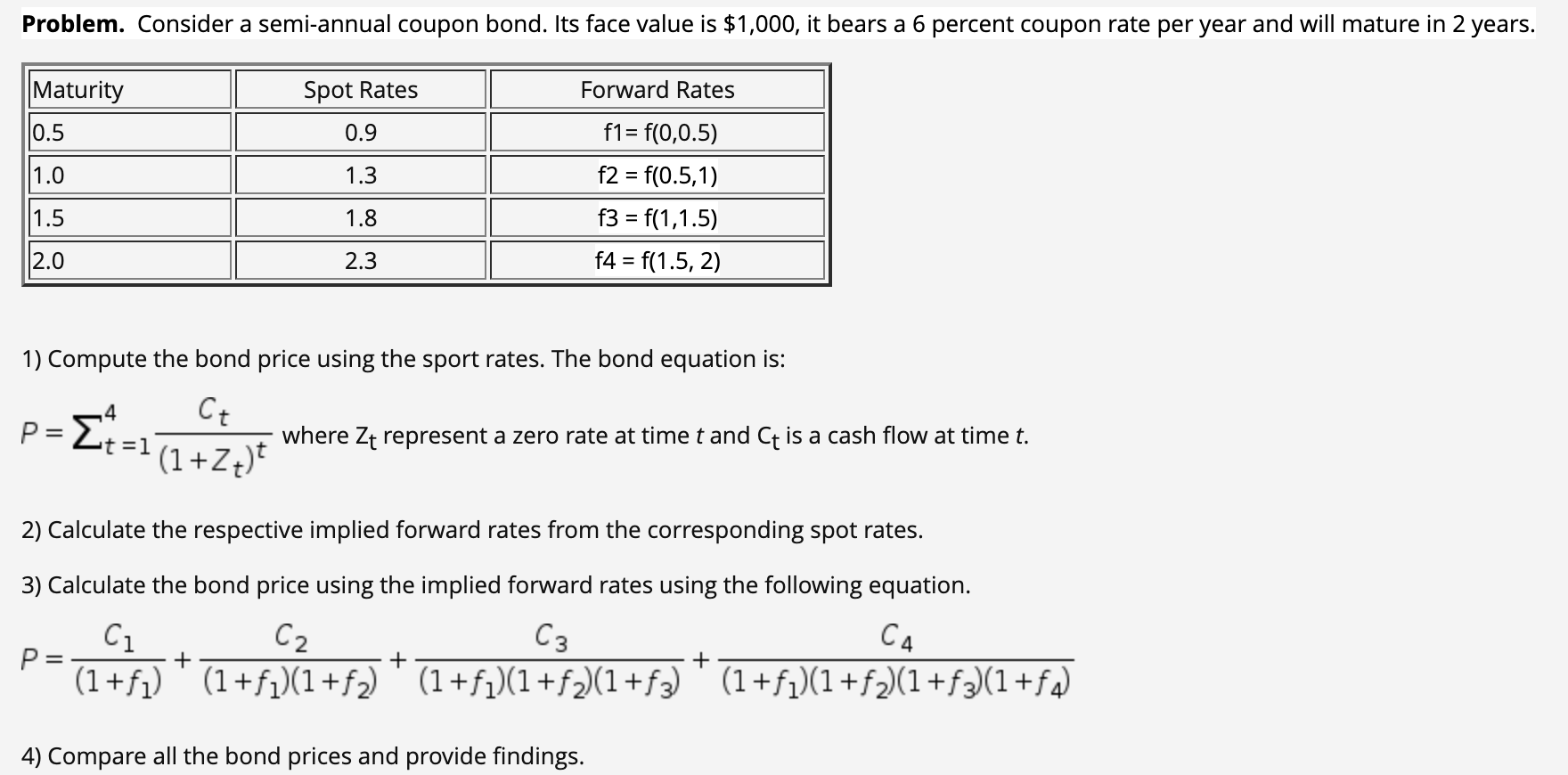

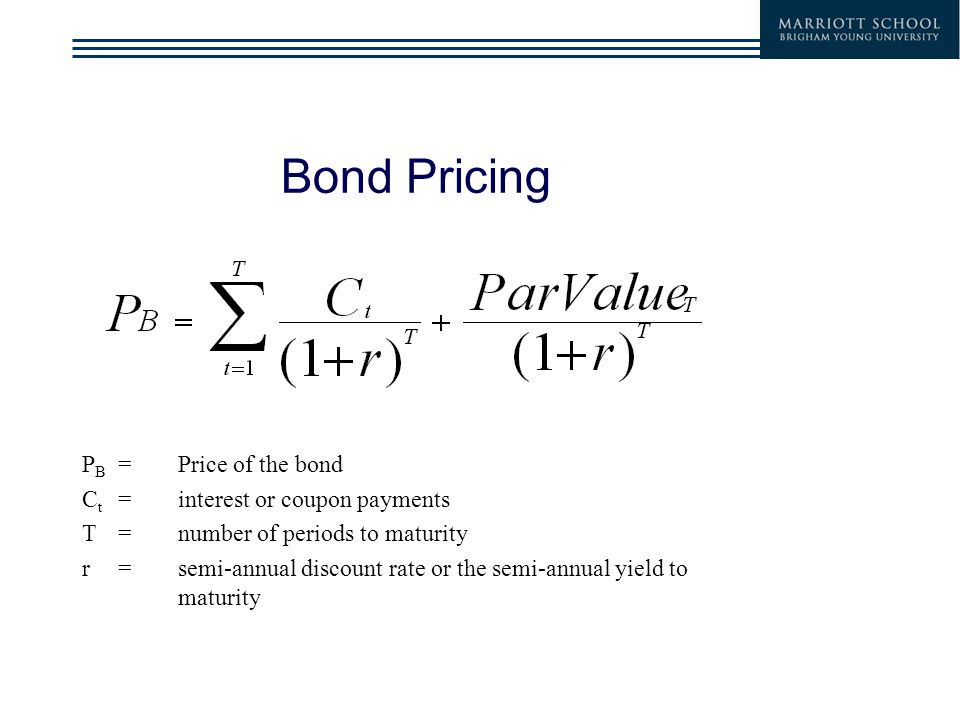

Bond Pricing P B =Price of the bond C t = interest or coupon payments T= number of periods to maturity r= semi-annual discount rate or the semi- annual. - ppt download